Compound interest explained

What is Compound Interest?

If you're looking into a lifetime mortgage, it's helpful to understand how compound interest affects your home's equity. Unlike a residential mortgage, there are no regular repayments unless you choose to make them (optional partial repayments). Instead, interest is added to the loan, and over time, you pay interest on both the original amount and the interest already added-this is known as compound interest, and it can increase the total amount owed.

What’s the difference between compound interest and simple interest?

Simple interest also referred to as a reducing balance interest is calculated only on the original amount. The interest doesn't change over time, making it predictable compared to compound interest. The difference between simple and compound interest is that one interest stays the same and the other accumulates, think of compound interest as 'interest-on-interest'.

No negative equity guarantee

A no negative equity guarantee is a standard guarantee of Pure Retirement lifetime mortgages and means you’ll never owe more than the value of your home when it's sold.

ERC-free repayments

ERC stands for Early Repayment Charge and ERC-free repayments mean you can repay part or all of your loan early without paying a penalty, giving you more financial flexibility.

Compound interest explained

If you release £50,000 with a 5% monthly interest rate, then for the first year there'd be a total interest of £2,558.10 added to the loan that year. The total outstanding balance would be £52,558.10. In the second year, the interest is calculated on £52,558.10, resulting in £2,688.95 interest.

| Year | Balance at start of the year | Interest charged (compounded monthly) | Total outstanding balance end of year |

|---|---|---|---|

| 1 | £50,000.00 | £2,558.10 | £52,558.10 |

| 2 | £52,558.10 | £2,688.95 | £55,247.05 |

| 3 | £55,247.05 | £2,826.55 | £58,073.60 |

| 4 | £58,073.60 | £2,971.16 | £61,044.76 |

| 5 | £61,044.76 | £3,123.18 | £64,167.94 |

This example is for illustrative purposes only. Your independent financial adviser will talk you through how compound interest impacts your lifetime mortgage, should you chose this as your later life borrowing option.

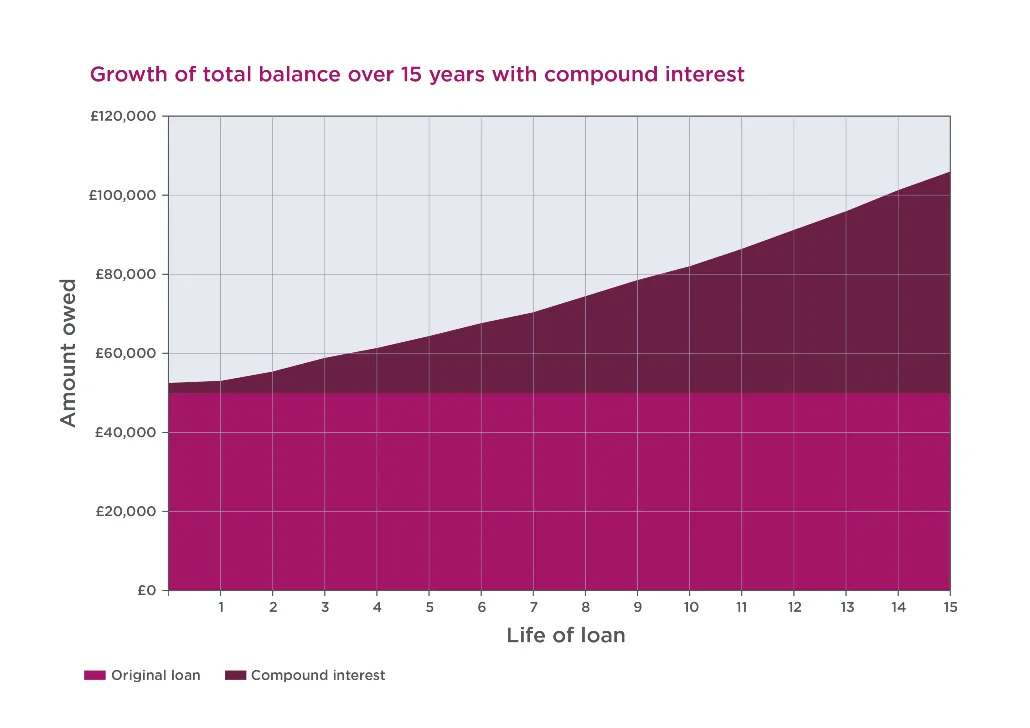

How compound interest grows over 15 years

In this example, releasing £50,000 of equity at 5% interest would grow to a total outstanding balance of £105,685.18 at the end of 15 years Lifetime mortgages have a no negative equity guarantee, meaning you'll never owe more than your property is worth when sold. Our graph demonstrates how interest accumulates over time.

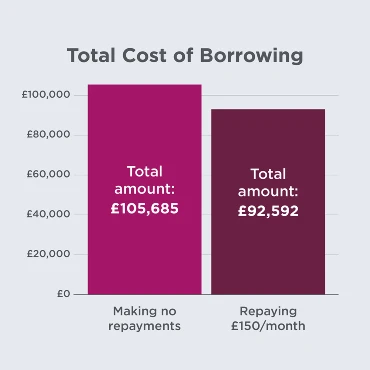

How to reduce total cost of borrowing

All of our lifetime mortgages enable you to repay part of the loan, if you wish to do so. These payments are known as 'optional partial repayments' and your adviser can help you decide how much to repay to prevent any early repayment charges. Making repayments, even small ones, reduces the amount of interest you pay over the lifetime of your loan and thereby reduces the total cost of borrowing.

If you decide to make payments, you can choose between ad hoc, one-off payments or set up recurring ones through standing orders or Direct Debits.

In this example, the loan is £50,000, with a fixed 5.00% MER interest rate, and after 15 years with no repayments, your total cost of borrowing would be £105,685. If you were to make a monthly £150 repayment, after 15 years, you'd owe £65,592 - with a total cost of borrowing, including the £27,000 repayments, of £92,592. This means, by repaying £150 a month, you could benefit from a £13,093 net interest saving.

Drawdown plans

A drawdown lifetime mortgage allows you to access your funds in stages and when needed rather than as a lump sum. With drawdown plans the interest is only charged on the amount of the loan you draw out rather than the full lump sum. This gives you more flexibility and more control on how much interest rolls up over time compared to a lump sum lifetime mortgage.

Find out more about lifetime mortgages

Explore the Frequently Asked Questions area of the website to learn more about lifetime mortgages and what to consider when exploring if a lifetime mortgage is right for you.

View FAQs